The Kansas City Market after the Tax Credit

People are asking me how the market is responding to the end of the federal home buyer’s tax credit. This is a tricky question for me. First of all, I know it is not a popular sentiment, but I wish there had not been such a huge tax credit in the first place. I wish the government would have just left it alone to recover instead of creating false demand and a hurried, strange buyer-favored market. It just seems counter intuitive to solve a economic crisis that was created by banks and mortgage companies by creating a false market which leaves a glut of houses and a buyer vacuum in its wake. Factually, buyer showings have declined sharply and there have been half as many homes go under contract this month as compared with the same period last month.

Luckily, life goes on. People have babies, move, get married, change jobs, or whatever other life change must happen for them to decide to move, buy or sell real estate. In addition, many people move in the warmer, summer months (while school is out), so hopefully that will hold true this year. I am not surprised that May has been a terrible month so far because most of the buyers that were out looking made their decision by April 30 to qualify for the credit. There will be a new round of buyers, and things will cycle through and eventually improve. I expect to feel the impact throughout the remainder of this year, but I also believe will we see a steady increase of activity with balance returning next year.

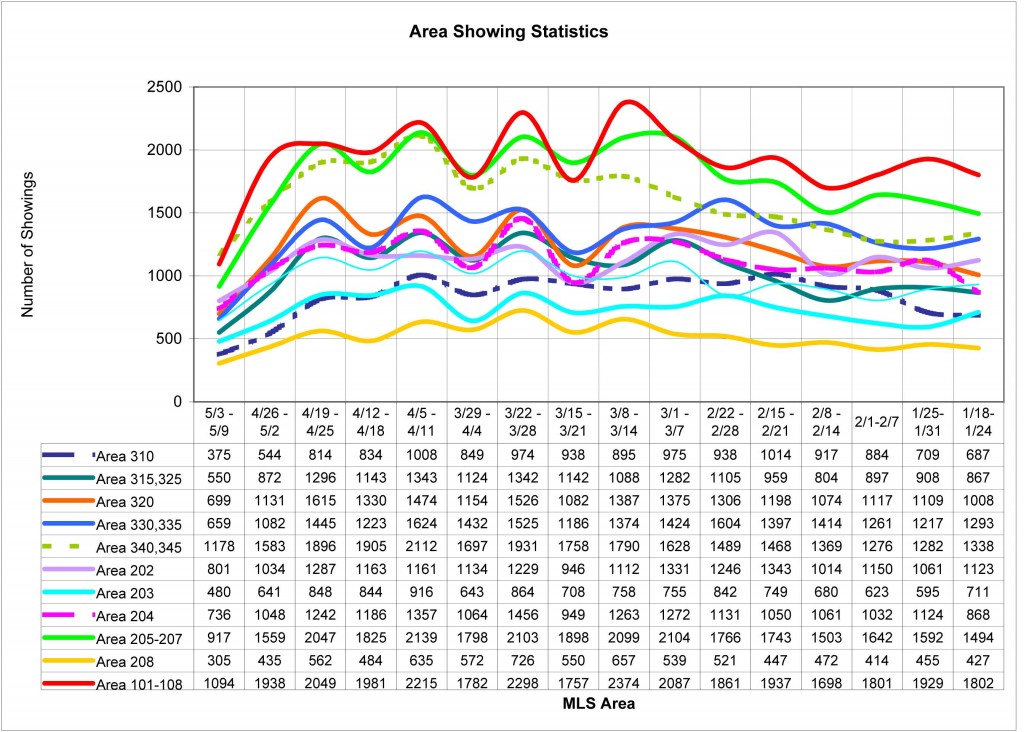

The chart below depicts the number of area showings by week. See how the line falls sharply down on the left? Showings have fallen, and are at depths-of-winter levels. Again, I expect it to rise, but currently this is the big picture…